llc s corp tax calculator

Estimated Local Business tax. Gross to Net Net to Gross Tax Year.

Converting From C To S Corp May Be Costlier Than You Think

Annual state LLC S-Corp registration fees.

. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. How Will A Business Tax Calculator Help Small Businesses Business. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount.

Form 1120 or the taxable income of last year may be used to compute your corporations taxes. Corporate tax rate calculator for 2020. How Will A Business Tax Calculator Help Small Businesses Business Tax Filing Taxes Llc Taxes.

The SE tax rate for business owners is 153 tax. S corp owners must also pay. Annual cost of administering a payroll.

This calculator helps you estimate your potential savings. Calculating Your LLC Tax Savings is as Easy as 1-2-3. OLPMS - Instant Payroll Calculator.

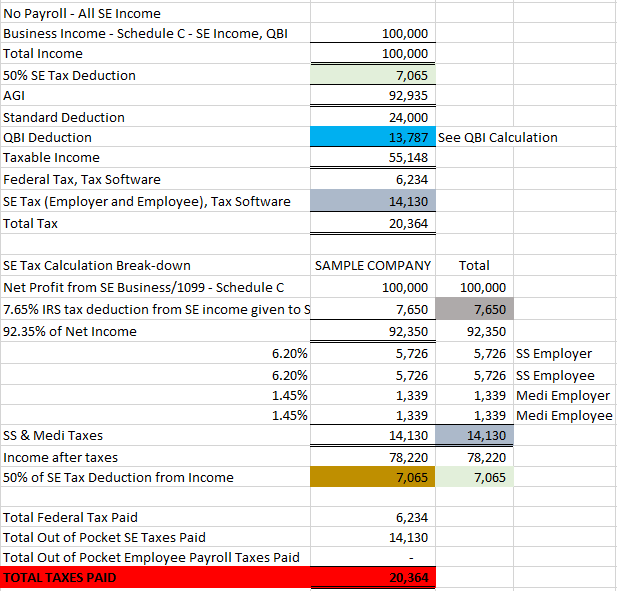

Llc s corp tax calculator. 26 rows Your business earns 100k in revenue and has 50k in business. Electing S corp status allows LLC owners to be taxed as employees of the business.

Asking the IRS to consider your LLC as an S. LLC S-Corp C-Corp - you name it well calculate it Services. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Additional fees include employment payroll self-employment tax federal income tax and accumulated earnings tax. S corp owners are required to pay themselves a reasonable salary as employees and that salary is subject to payroll taxes more on this below. Just complete the fields below with your best estimates and then register to get your CPA or schedule a free Consultation here 1 Select an answer for each question below and we will calculate your LLC tax savings.

Taxes are determined based on the company structure. This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S. Corporate tax rate calculator for 2020.

In that ruling the agency addressed the issue of whether an S corporation can convert to an LLC file an election to retain its tax treatment as a corporation and also hold onto its S status. The LLC tax rate calculator is used by corporations to calculate their taxes. This tax calculator shows.

Lets calculate your canadian corporate tax for the 2020 financial year. Our small business tax calculator has a. Additional Self-Employment Tax Federal Level 153 on all business income.

Total first year cost of S-Corp. This application calculates the. S Corp Tax Calculator - S Corp vs LLC Savings.

Use the S-Corporation Tax Calculator to compare self employment tax savings over a sole proprietorship. Annual cost of administering a payroll. This allows owners to pay less in self.

Find out why you should get connected with a CPA to file your taxes. Forming an S-corporation can help save taxes. From the authors of Limited Liability Companies for Dummies.

Social Security and Medicare. With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid. Lets calculate your canadian corporate tax for the 2020 financial year.

We are not the biggest. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. Find out why you should get connected with a cpa to file your taxes.

For example if your one-person S corporation makes 200000 in profit and a.

What S The Llc Tax Rate How Limited Liability Companies Are Taxed Bench Accounting

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Small Business Tax Calculator Taxfyle

Llc Vs S Corp What Are They And How Are They Different Forbes Advisor

Free Llc Tax Calculator How To File Llc Taxes Embroker

Discover How Incorporating An Llc Can Save Money On Taxes

S Corp Payroll Taxes Requirements How To Calculate More

Tax Savings Calculator For Llc Vs S Corp Gusto

How An S Corporation Reduces Fica Self Employment Taxes

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Investment Return Illustration Llc Vs C Corp Central Texas Angel Network

How To Save On Taxes By Electing To Be Taxed As An S Corp Houston Tx Certified Public Accountant Accounting Tax Financial Services Quickbooks Huda Cpa Firm Pllc

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

At Tax Time How To Weigh The Benefits Of A C Corp Vs An S Corp Vs An Llc Vs A Sole Proprietorship Inc Com

Can I Convert My Llc To An S Corp When Filing My Tax Return Turbotax Tax Tips Videos

Calculate S Corp Taxes Using An S Corp Calculator Youtube

What Is Self Employment Tax 2021 22 Rates And Calculator Bench Accounting